Most accurate mortgage affordability calculator

Browse through a vast selection of bank loan packages using our mortgage tool. Try our home affordability calculator.

Free 9 Home Affordability Calculator Samples And Templates In Excel

There are no credit checks.

. Mortgage Affordability Calculator. But remember even if you can afford the monthly payments you still need to qualify for a home loan. For FHA loans there is an upfront and annual mortgage insurance premium.

The length by which you agree to pay back the home loan. For home buying the Rent vs. This would usually be based on 4-45 times your annual income but some mortgage lenders stretch to 5 times salary and some even higher than that.

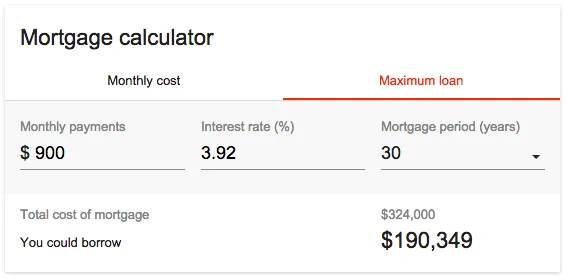

You can edit your loan term in months in the affordability calculators advanced options. A mortgage calculator can be helpful when estimating your home buying budget. Calculate your monthly payment.

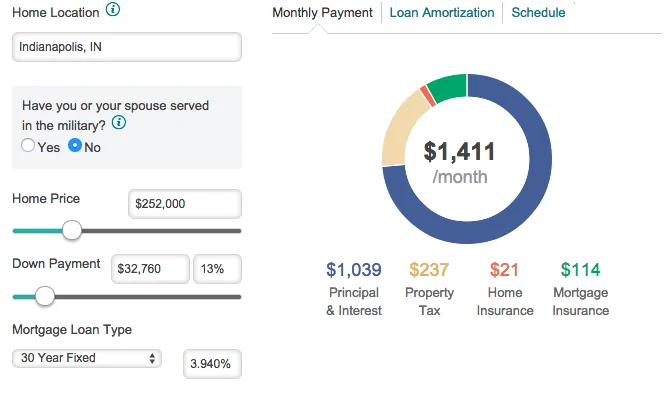

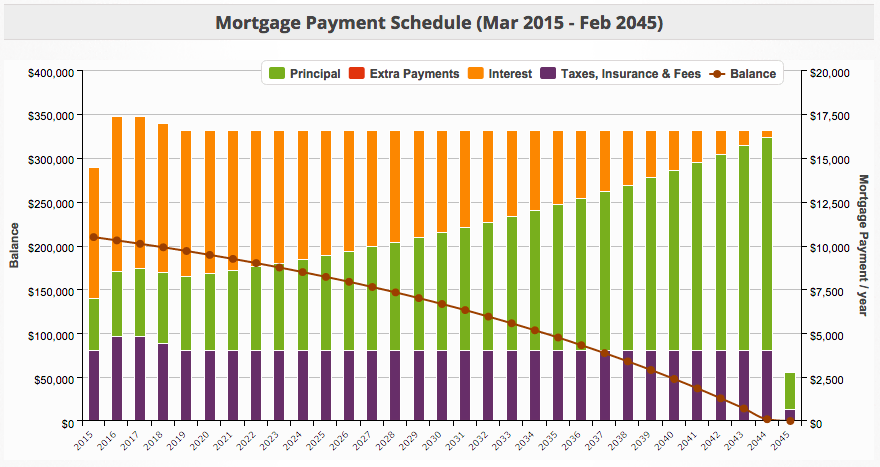

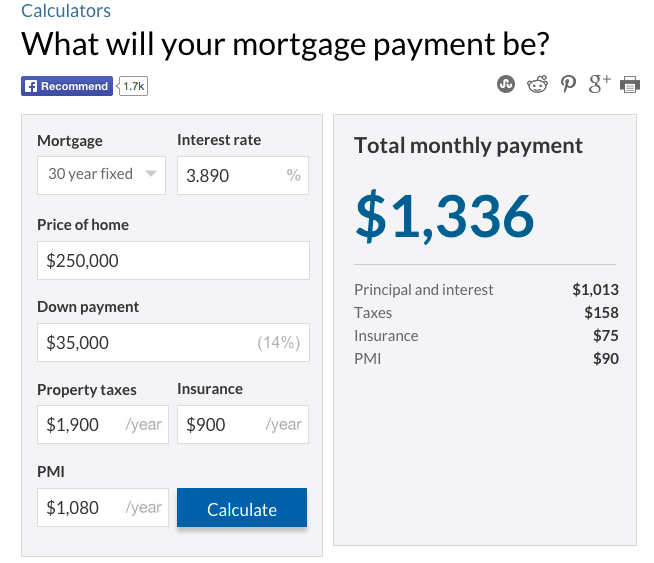

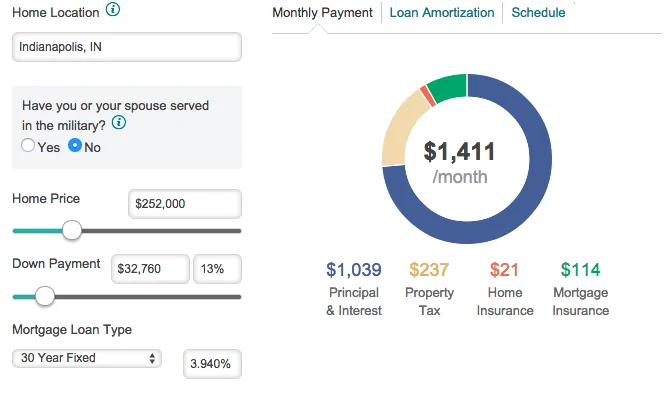

Here are the average annual percentage rates today on 30-year 15-year and 51 ARM mortgages. Enter the price of a home and down payment amount to calculate your estimated mortgage payment with an itemized breakdown and schedule. Home Loan Refinancing Calculator This is a simple housing loan calculator that estimates how much you can save on your monthly housing loan instalments if you refinance your property.

You Could Lose Your Home. Taxes Other Fees. Most mortgage lenders charge an origination fee which is usually around 1 of the total cost of the loan.

Home loan comparison - You can compare the best housing loans for your need. If a reverse mortgage lender tells you You wont lose your home theyre not being straight with you. The calculator does not include costs for private mortgage insurance.

A mortgage calculator is a smart first step to buying a home because it breaks down a home loan into monthly house payments based on a propertys price current interest rates and. Home price Down payment Down payment percent Loan program. 140000 100 1400.

Based on a 350000 mortgage. If you want a more accurate quote use our affordability calculator. Most people need a mortgage to finance a home purchase.

Todays Mortgage Rates Today the average APR for the benchmark 30-year fixed mortgage remained at 3. With a 30-year fixed-rate mortgage you have a lower monthly payment but youll pay more in interest over time. If you save for a bit longer and have a bigger deposit we might be able to lend you more.

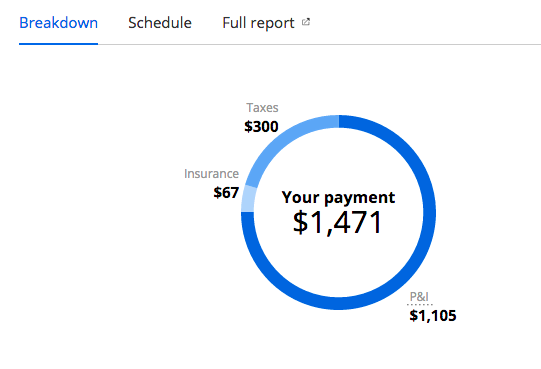

Your mortgage payment includes your principal and interest down payment loan term homeowners insurance property taxes and HOA feesThis gives you the ability to compare a number of different home loan scenarios and how it will impact your budget. Use HSHs PMI calculator to get an accurate monthly cost estimate for PMI. The most common loan terms are 30-year fixed-rate mortgages and 15-year fixed-rate mortgagesDepending on your financial situation one term may be better for you than the other.

A break-even period of 25 months is fine and 50 might be too but 75 months is too long. Theres a good chance you will refinance again or sell your home in the next 625 years. Even if you.

If you make a down payment of less than 20 percent on a conventional loan you will need to pay for private mortgage insurance. 5000 x 28 140000. Estimate how much youll pay each month for your new home with our easy-to-use mortgage calculator.

Youll be required to pay PMI if your down payment is less than 20. What is a mortgage affordability calculator. We wont save your personal information.

With a 30-year fixed-rate mortgage you have a lower monthly payment but youll pay more in interest over time. Its a tool that gives you an accurate estimate of how much you could borrow from us for a residential mortgage in the UK. The more accurate your estimate will be.

Mints home affordability calculator looks at your income savings for a down payment your monthly debt so that you can see how much house you can afford. To get the most accurate picture of what you qualify for speak to a mortgage broker about getting a mortgage pre-approval. Use Zillows home loan calculator to quickly estimate your total mortgage payment including principal and interest plus estimates for PMI property taxes home insurance and HOA fees.

What information do I need to use the. Youll need to spend a little longer on this. Enter your salary below combined salaries for a joint application to see how much you could potentially borrow.

Buy Calculator considers one-time costs closing costs and the down payment and ongoing expenses like property taxes. You can give estimates for any figures you dont know exactly. Use our mortgage calculator to estimate your monthly house payment including principal and interest property taxes and insurance.

Mortgage calculator Affordability calculator Refinance calculator. Your maximum monthly mortgage payment would then be 1400. In general a 20 down payment is what most mortgage lenders expect for a conventional loan with no private mortgage insurance PMI.

You have a lot of loan options as a homebuyer but fixed-rate mortgages are the most commonly used. Think about the reasons you were considering getting a reverse mortgage in the first place. The most current Ontario mortgage rates are already included in the calculator above so you can trust the numbers we provide to be accurate.

Redfins mortgage calculator estimates your monthly mortgage payment based on a number of factors. Ontario sales tax on CMHC insurance When applicable the cost of CMHC insurance is added to your mortgage balance and paid off over the amortization of your mortgage. Your budget is too tight you cant afford your day-to-day bills and.

Start web chat Call us. Our fixed-rate mortgage calculator can help you figure out if a 15-year or 30-year mortgage is a better match for both your current financial situation and your future earnings. The most common loan terms are 30-year fixed-rate mortgages and 15-year fixed-rate mortgagesDepending on your financial situation one term may be better for you than the other.

The most common term for a mortgage is 30 years or 360 months but different terms are available depending on the type of home loan that works best for your situation. You absolutely can lose your home if you have a reverse mortgage. The purpose of the fee is to cover expenses like application processing underwriting the.

Keep in mind that the mortgage affordability calculator can only provide an estimate of how much youll be approved for and assumes youre an ideal candidate for a mortgage. Chat to us online if you have a question about using our mortgage calculator. Total Monthly Payment Breakdown.

Top 20 Mortgage Calculator Tools Startup Stash

Top 20 Mortgage Calculator Tools Startup Stash

5 Best Mortgage Calculators How Much House Can You Afford

5 Best Mortgage Calculators How Much House Can You Afford

![]()

Mortgage Calculators Loan Comparison Calculators

Free 9 Home Affordability Calculator Samples And Templates In Excel

How Much House Can I Afford Calculator Money

Are Mortgage Calculators Accurate Why Some Totally Miss The Mark

Top 10 Free Mortgage Calculator Widgets

Can I Afford To Buy A Home Mortgage Affordability Calculator

Free 9 Home Affordability Calculator Samples And Templates In Excel

Mortgage Affordability Calculator 2022

5 Best Mortgage Calculators How Much House Can You Afford

5 Best Mortgage Calculators How Much House Can You Afford

5 Best Mortgage Calculators How Much House Can You Afford

5 Best Mortgage Calculators How Much House Can You Afford

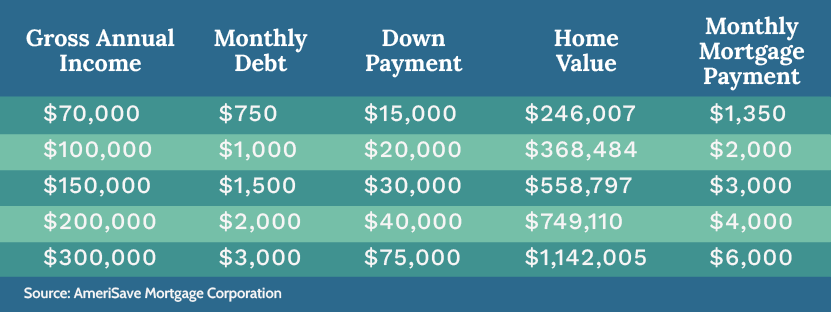

Calculate How Much You Can Afford Home Affordability Amerisave